Industry is on the Verge of Listening to the Audience

Content Insider #743 – Measuring

By Andy Marken – andy@markencom.com

“We fight smart, be patient and pray. Seriously, pray!” – Charlie Kenton, “Real Steel,” Dreamworks, 2011

Okay, we have to ask you a few personal questions.

Have you ever seen a paper diary people are supposed to use to accurately record their individual TV viewing?

If you somehow did, was it filled it out faithfully?

How about a personal people meter – no not a purple people eater – A personal people meter that measures what is viewed in and out of the home?

If so, did someone hit the appropriate buttons all the time?

Amid all of the solicitor calls you have received, have you ever had someone call you and asked what you watched on your screen this past week, which pieces you watched all the way through and which one(s) you liked?

If so, did you hang in there with the caller and answer his/her questions … honestly?

If you can answer yes to any of these questions, you’re freakin’ weird.

If you answered no to them then you’re … normal!

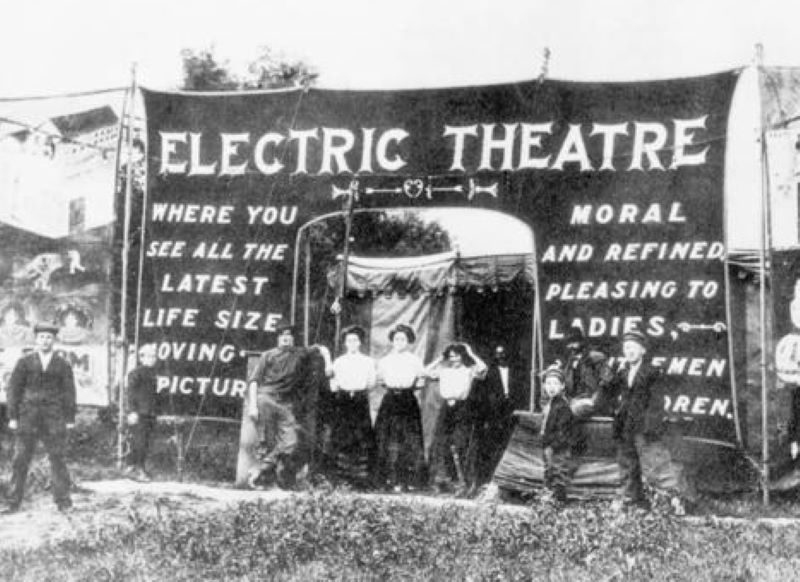

Count On It – Since the earliest of days of the M&E industry, people liked to count viewers and seats in seats. It was a way to project success for everyone involved.

Even before the days of management gurus, Peter Drucker and Edmund Deming people have had this need to count stuff and keep track of totals.

Pretty complete and accurate theatrical box office, television audience ratings, and home video rental performance have been available and accepted for as long as the respective venues have been around.

Oh, sure what they mean depends on who you work for and who you represent, but at least the numbers are agreeable starting points.

Movie houses have had a number of tough years (declining ticket sales since early 2000 and no seats in seats for almost all of the past two years); but with the new normal, they slowly began to regain their old bravado.

Theaters Open — Even in the early days, movie houses touted the fact that they are places of refuge from the problems of the day. While the content may have shifted slightly, the goal was always the same…put seats in seats.

While they were happy with the numbers, theater owners have been slightly concerned that they aren’t attracting back the “regular crowd.”

Perhaps because of the genre of the film releases (the heavy emphasis on superhero and horror), theater attendance has been heavily weighted to the 15-24 age crowd and more specifically, female. Of course, that may be because increasingly, there are more female superheroes, victors in films and series.

At the same time, there has been a significant drop in millennial and 50 plus attendance of both sexes.

Industry experts are divided on whether the attendance shift is because older folks and parents have greater health concerns or anytime, anything, anywhere viewing may have become a habit rather than a temporary viewing shift.

Time will tell.

Still, theater owners, directors, talent and agents are anxious to tell the media – and public – how well attendance is rebounding, even though it is only at the 1980s level and how important it is for people to see great projects as they were meant to be enjoyed – an ultra large screen, immersive Dolby Atmos sound and shared in the dark with a few hundred strangers.

The creators and movie houses also like to remind folks of the fact that the only way for film projects to make money for studios (and the participants) is by having seats in seats.

Whether it’s a day/date release like Dune or a 45-day theatrical window like Top Gun: Maverick, the crew highlights the box office results even as the streamers report the “outstanding” viewership they had with new and existing subscribers.

Gotta Be – Having a film/show people want to watch is exciting for directors and actors, A Listers and everyone involved in the project wins–especially when people recognize their peers as with Sally Fields when she shouted out during the Oscars, “you really like me.”

Of course, the A Listers want the theatrical window to be as long as possible because they have a lot of skin in the game when it comes to their front-end/back-end payments.

However, the contracts are now being totally rewritten so studios and project owners have greater flexibility on where/when films/series are shown and the duration (name calling, and lawsuits can get so messy, nasty).

Another big reason for a video story to be shown in theaters is so it and all of the participants can also be considered for the industry’s seemingly endless list of awards. It’s nice to be recognized by your peers.

However, with the emergence of the video streaming industry a little over 15 years ago, streaming revenue has reached more than $13.5B annually.

YouTube reigns the world’s number one streaming platform worldwide with more than 2.29B users watching more than 1B hours of content daily.

The increased availability of high-speed, economic broadband marked the rise of Netflix, Amazon Prime, Hulu, Apple TV, iTV, Joyn +, AcornTV, BritBox, Cinesquare, Filmdoo, iview, Spotify, Stan, Tencent, IQiyi, Youku, and hundreds of other local, regional streaming video services as consumers dropped their conventional cable TV packages to subscribe to one or more SVOD service.

It looked like such a good, easy, profitable way to go directly to consumer with their luscious content that every major studio (except Sony) and TV network has jumped into the ring to take on the other guy and knock them out in a few rounds while encouraging more pay TV folks to scrap their bundles to win more subscribers.

Tough Fight – The film industry took a terrific beating when theaters were closed and delivering a strong return for studios was difficult. The industry took a heck of a beating but still got back up to fight another round.

According to its recent research report, TiVo reported that the average consumer spends $142.20/mo. for broadband and video services–about the same as a cable/internet bundle costs.

The report noted, ““Around 11 percent of respondents said they canceled pay-tv service within the last six months. Of those, 73 percent cited price as a factor in their decision. Still, nearly 70 percent admitted they’re not sure if they’re actually saving money on entertainment.”

Or, to paraphrase an old saying, “Savings are in the eye of the beholder.”

Diversity Counts – Movies and shows have amped up their focus on ensuring that the storylines reflect our broad society in sex, age, nationality, race and other factors. The focus is especially important in ad-supported services because it enables marketers to identify with the broader public.

To help consumers control their entertainment costs, organizations have also added AVOD (ad supported) services such as Pluto TV, Tubi, IMDB tv, Rakuten, Fuji TV, Wavve, 9Now, and other local and regional broadcasters and operators.

Yes, YouTube is still the king of the hill when it comes to AVOD, producing $7B plus ad revenue quarterly.

All of the AVOD services are finding increasing opportunities to attract a steadily growing audience as SVOD services slowly but steadily increase their subscription fees.

Surprise!

Global Growth – By streaming entertainment across the internet, content services have been able to expand their reach around the globe with content tailored for everyone. Source- broadband research

And still the potential streaming market grows:

- 7.9B people worldwide, average 4.9 people per household

- 1B + pay TV subscribers WW

- More than 1.2B household broadband connections worldwide

- 1.7B digital TV households worldwide

- 6.7B smartphone users worldwide

In other words, there’s a lot of growth potential and headroom for the streaming market.

Of course, it wasn’t much back in 2007 when Reed Hastings was looking for a way to slash Netflix’s post office bill (we’re not sure about this but…).

Patient Growth – A number of networks and studios thought Netflix was doomed to failure in going up against the big cable bundles. They didn’t count on people being fed up with being dictated to what they could watch, where they could watch it and when. Of course, folks were also tired of the big ad overload per hour as well as growing bundle costs, lack of support and really good/great content.

He figured if YouTube could make a few bucks selling ads around folks’ cat, dog, dumb/dumber videos; the Red Envelope company could do better by delivering movies and shows to subscriber screens free of ads and “inexpensively” …BAM!

Other tech firms – Amazon, Apple and content delivery people like Hulu, Sling TV, Vimeo and others liked the idea.

They joined the new breed, telling families they could ditch – with a little difficulty – their old expensive and poorly supported cable bundle and suddenly watch what they wanted, when they wanted and ultimately on the screen they wanted (as long as the streamer had it).

It worked great for a while because streamers could rent content from studios/network libraries and even have them produce stuff just for them.

Consumers loved the idea and the services only cost $8 – $15, depending on the service owner.

People everywhere shed their cable bundle and signed up for a couple of streaming services.

Yeah, that caught the interest of networks, studios around the globe who could cut out the middleman and offer their own eye-watering content bundles.

The hurdle for a streaming service to reach people in a new country was that they had to produce 30-40 percent of the streamed content locally.

That was great because it gave the various streaming services access to fantastic local/regional stories they can offer at home and around the globe.

The services have grown nationally and internationally as they discover that content is universal.

Good video stories – such as Ted Lasso, Squid Game, Raised by Wolves, Flight Attendant, Bridgeton, Snow Piercer, Parasites, Dopesick, Foundation, See, The Boys, Cobra Kai, Mandalorian, The Queen’s Gambit, Witcher, House of Cards, The Battle of Lake Changjin, Ozark, and hundreds of other projects are appealing no matter where you live.

Just take a look at the top 10 global SVOD services:

- Netflix – 210M +, 192 countries

- iQiyi – 125M, 191 countries

- Amazon Prime – 200M, 100 countries

- Disney + – 200M, 50+ countries

- Tencent – 100M, 10 countries

- Apple TV + – 40M, 40 countries

- HBO Max – 65M, 20 countries

- Hulu – 40M, 10 countries

- Peacock – 42M, US only

And since no one service offers all of the content an individual/family wants to view – assuming you can find what you’re looking for on your service(s) – people simply add/drop providers.

Growing Hunger – Once consumers cut their cable bundle and signed up for their first streaming service, they began to discover not all the good stuff was on one app so they added other services to meet their ever-changing viewing appetites.

Conviva Research found that 4 out of 10 people simply stumble on a show, nearly 50 percent learn about the content through ads and 60 percent of the content watched is because of WOM (word of mouth).

We wasted a lot of time hoping to find just the right video story until we finally found two recommendation services we could rely on consistently – JustWatch and ReelGood. Sure, there are others, but JustWatch seems to have the best information on what people are streaming around the globe; and as a sanity check, there’s always ReelGood.

If that doesn’t help you, just go to your streaming app and let it pick something for you … they already know more about you than you know about you.

And therein lies the thickest smokescreen of all for streaming that is driving competitive services, especially AVOD services and advertisers right up the wall.

Nielsen has been struggling to make their national ratings service relevant so streamers and advertisers will subscribe to help streamers and agencies prove the value of companies advertising with them to reach/influence prospective customers economically.

Strictly SVOD services like Netflix aren’t interested in sharing subscriber data because firms don’t advertise with their service.

They’re also not interested in letting anyone know what is located in their deep, rich data vault.

After being suspended by MRC (Media Rating Council) because of its inability to actually count and track today’s new DTC (direct to consumer) population, Nielsen has been busy trying to reinvent the 98-year-old research firm to address the new streaming market.

It’s “reinvented” service, The Gauge, is still a work in progress according to Netflix’s Hastings, which doesn’t much care since they don’t sell advertising.

But a pat on the head from Netflix wouldn’t hurt.

Four years ago, Nielsen released rating numbers on Netflix series, Strange Things, and the company simply said, “not accurate, not even close.”

All Surviving – Industry analysts like to report that streaming services are rapidly stripping subscribers from pay-TV providers. Possibly, but it will take time because people’s likes/dislikes for entertainment is constantly changing.

With Gauge, Nielsen recently reported that linear TV (cable/broadcast) still dominates viewing habits.

It doesn’t take a rocket scientist to see that streaming is overtaking linear home entertainment–something the cable guys anticipated years ago.

With its acquisition of Sky in 2018, Comcast reinforced its intention to become a major connection for M&E providers and homeowners.

While well behind China Telecom and China Unicom in total subscribers, it is nearly tied with Japan’s NTT and is focusing on expanding its home reach in the Americas and EU.

Subscription video on demand (SVOD) services are remarkably coy about their viewership numbers.

Netflix, for example, publishes a weekly Top 10 list but does not indicate how many views went to No. 1 or how far behind No. 2 was, etc.

Title ranking doesn’t say much about week to week viewing shifts, binge vs. traditional viewing or how viewing varied by audience segment.

Netflix – and the rest of the streamers – places a lot of emphasis on overall and specific film/series revenue and market share, tracking new series numbers, how many watch episodes (and when they shift), storyline appeal to different audiences, social media trends and obviously, churn (audience acquisition/engagement/retention).

In addition to Nielsen’s shift to capture and sell this information to service providers, other deep data firms have entered the fray including Parrot Analytics, ComScore, GfK … all of the services

All of the streaming and rating services have their own set of metrics and performance benchmarks, but the biggest challenge comes in meeting the needs of AVOD services/networks and marketers because suddenly, they have the potential of knowing more about the subscriber/viewer – age, gender, race, ethnicity, platform preference, viewing habits/trends and more … lots more.

While each service and marketer is interested in how many, how often and how long for their content, it is also meaningful to understand what the other guys and non-viewers are doing so the firm can continue to grow.

Properly and ethically used, big data can do that more efficiently, effectively than diaries and panels.

It could also mean that every time a new film/series is released; it will be a knockout so the service, marketer and subscriber could agree with the ESPN Boxing Commentator when he observed, “Kenton must have hardwired this bot with the will to go on.”

Andy Marken – andy@markencom.com – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.