The Sonic Fund II, L.P. Files Definitive Proxy Statement and Sends Letter to Stockholders of Adverum Biotechnologies, Inc.

Believes Board’s Abject Failure to Exert Sufficient Oversight of Management Has Led to Significant Stockholder Value Destruction and Must Be Immediately Addressed

Adverum Is Abusing the Corporate Machinery to Entrench Incumbent Directors and Disenfranchise Stockholders

Company Has Lost Confidence of Stockholders Through Persistent Mismanagement and Repeated Scientific, Communications and Capital Allocation Blunders

Believes a Costly Proxy Fight Could Have Been Avoided Had Adverum Board Engaged Constructively with Sonic Rather than Taking Antagonistic Stance

Sees Current Board – Including Three Company Nominees for 2021 Annual Meeting – As Lacking Independence, Requisite Experience and Ability to Hold Management Accountable

Urges Stockholders to Vote on the GREEN Proxy Card Today to Elect Sonic’s Three Independent Director Nominees to Effect Sorely Needed Board Refreshment

HONOLULU–(BUSINESS WIRE)–The Sonic Fund II, L.P. (“Sonic”), which beneficially owns approximately 6.8% of the outstanding common stock of Adverum Biotechnologies, Inc. (NASDAQ: ADVM) (the “Company” or “Adverum”), announced today that it has filed a definitive proxy statement and GREEN proxy card with the SEC in conjunction with the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) that the Company is rushing to hold on May 12, 2021. Sonic has nominated three independent, highly qualified director candidates – Jean Bennett, Jodi Cook and Herbert Hughes (the “Nominees”) – for election to the Adverum Board of Directors (the “Board”) to serve until the 2024 Annual Meeting.

Sonic sent a letter to Adverum stockholders in connection with this filing. The full text of the letter is below and is also available at www.SaveAdverum.com.

April 19, 2021

Dear Fellow Stockholders,

Since 2018, The Sonic Fund II, L.P. (“Sonic” or “we”) has been a constructive investor in Adverum Biotechnologies, Inc. (NASDAQ: ADVM) (the “Company” or “Adverum”) and remains a steadfast believer in the tremendous potential of gene therapy for wet AMD to help patients. Over the last two years, however, we have grown increasingly dismayed at the Company’s lack of progress in addressing significant management and operational deficiencies that have destroyed stockholder value. Sonic suspects that these concerns are shared by many other investors, sell-side analysts, retinal surgeons and other stakeholders. In our view, the root causes of these failures are abysmal corporate governance and failed oversight by the Board of Directors (the “Board”), which must be rectified immediately.

Sonic has privately endeavored to assist the Company in enhancing its standing in the marketplace, identifying management and Board talent that management has been unable to attract on its own, and offering strategic input from the perspective of a major engaged stockholder. Adverum’s well-informed stockholders can dispassionately evaluate Sonic’s ideas for themselves and decide if the sitting Board would have better served stockholders by embracing them rather than spurning them. As part of these efforts, we recently presented the Board with five exceptionally well-qualified director nominees, including three women with exemplary scientific qualifications. These candidates represented some of the most talented drug development, gene therapy and ophthalmology professionals extant, as well a capital allocation expert to help address the Company’s financial mismanagement.

Rather than considering our nominees in good faith, Adverum instead elected to force a wholly unnecessary proxy contest. Consider that on March 15, Sonic privately sent a letter to Chair Patrick Machado detailing various governance failures of Adverum and presented him with five highly qualified independent individuals for Adverum to consider. In this letter we stated that our lawyers would reach out to Adverum’s external counsel to see if there was a possibility of a private settlement that was in the best interest of shareholders. Much to our surprise and disappointment, two days after our private letter, Adverum issued a confrontational public press release in which they rejected our nominees and named a slate of three individuals they planned to run.

Consider that in its April 15 letter to stockholders, the Company notes that it intends “to recruit a high-quality director with product and commercial gene therapy experience to be named in 2021.” Given the unquestionable quality of the nominees we suggested to Adverum, we question why the Company has written them off and, according to the Company’s disclosure, instead chosen to spend nearly $7 million to keep our independent nominees off a Board that, by their own admission, they intend to expand while denying you, the stockholder, any chance to vote on their unnamed 2021 appointment. This is neither normal nor appropriate.

To make matters even worse, the Company has turned its back on good governance and a level playing field and has repeatedly attempted to use its corporate machinery to disenfranchise stockholders while hoping they won’t notice – ranging from misleading and contradictory statements about the number of directors up for election this year to flip-flopping guidance as to the future size of the Board. Upon close inspection, the past and future “refreshments” that Adverum references in its public statements constitute attempts to entrench the incumbent regime by ensuring that you can vote only for loyalists and known commodities. Sonic’s nominees offer you independent talent and new perspectives. It is your choice, and yours alone.

On a related point, the Company fully understands they will need three female directors by the end of 2021 to comply with Sections 301.3 and 2115.5 of the California Corporations Code (implementing SB 826) (“SB 826”), the California Board gender diversity law. In fact, they are asking you to vote for a slate that they know will be non-compliant with applicable law at year-end, which may make you wonder what the Nominating and Governance Committee has been doing for the last year. It may even strike you as disingenuous of them to suggest that a planned addition referenced in the April 15 letter is part of their ongoing refreshment efforts. Additionally, even if the Company prevails in the proxy contest and adds an additional unelected female director afterwards, they will still be one short of the requisite number. Therefore, the Company will claim to be legally required to foist two presently undetermined female directors on stockholders without any vote. This begs the question of why the Company was – and apparently remains – so opposed to considering the three highly qualified women that we initially nominated.

Sonic is committed to delivering the spectacular returns that long-suffering stockholders of Adverum deserve. We think that requires a dramatic upgrade to the Company’s governance and directors committed to rigorous management oversight. We need to prevent another massive hit to the stock price resulting from mishandled stewardship and messaging of what we believe is a promising drug that will greatly help patients. As currently configured, the Board has plainly and repeatedly failed. It is time for change.

We are therefore seeking your support for the election of our three highly qualified nominees to Adverum’s Board at the 2021 Annual Meeting of Stockholders, currently scheduled to be held on Wednesday, May 12, 2021 (the “2021 Annual Meeting”). These nominees – all of whom are independent of Sonic and of each other – would bring fresh perspectives to the Board, and would be committed to providing effective, fact-based oversight to both management and the drug development process. In making your decision, we ask that you consider the following points.

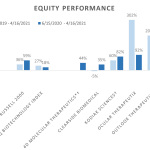

Adverum Has Destroyed Tremendous Stockholder Value

When it comes to creating sustained, long-term value for stockholders, Adverum has failed miserably in recent years. Since the beginning of 2020, Adverum’s performance has lagged the Russell 2000, the Nasdaq Biotechnology Index, and a peer group of related ocular drug development companies. Since CEO Laurent Fischer’s hiring on June 15, 2020, the underperformance has been devastating. In a period of wild market exuberance, Adverum’s stock price has been more than cut in half. The enterprise value of the Company was $1.6 billion when Dr. Fischer joined; it was under $630 million at the last reported quarter.

Adverum Has Resorted to Questionable Tactics Aimed at Disenfranchising Stockholders

Unfortunately, only a skilled mental gymnast could comprehend the maneuvers that Adverum has employed in recent weeks to obfuscate the ultimate size and composition of the Board. What is clear, however, is that the incumbent Board is taking desperate steps to avoid a true refreshment.

Consider their conflicting messages around the number of directors up for election:

- First, in its 10-K dated March 1, they announced an intention to run two directors although the class held five seats.

- Then, on March 16, Adverum representatives separately represented to Sonic and Sonic’s counsel that the Company intended to run only two directors at the 2021 Annual Meeting. That “truth” lasted about 24 hours.

- Then, on March 17, the Company announced it was running three directors, including one who previously wanted to step down – contradicting its recent 10-K disclosure mentioned above. In this announcement, Adverum advised that following the 2021 Annual Meeting, the Company would have a continuing Board of nine directors. This is counterintuitive on its face as the Company would have to add additional female directors in 2021 to reach the three required under California law.

- Finally, on April 15, in a letter to stockholders, the Company indicated that it planned to add a fourth new director at some point in 2021, signaling that stockholders would not be able to vote on that fourth director.

- Were the Company’s slate to prevail in the proxy contest and the Company to add an unelected female director, the Company would still fall short of the three female directors required by SB 826. Therefore, the Company will need to an add another unelected woman, a fifth new director.

We sympathize if this is hard to follow. Let’s try this a different way. There are currently 11 directors on the Board. First, the Company told the public they will reduce the size to 8, which they repeated to us on March 16, the day after our private letter. The next day in its confrontational Press Release, the Company announced there would be 9 directors. On April 15, they touted that they would add a mystery unelected director later this year, bringing the total to 10. California law dictates that the Company must have three female directors by the end of the year. Given that the Company’s slate has only one female candidate, simple math reveals that they actually need to add two unelected female directors to meet this requirement, bringing the total number of directors back to 11 by the end of 2021.

Analyzing these events closely, it becomes clear that if the Company prevails, it will have a Board in which five seats are held by Chair Patrick Machado, CEO Laurent Fischer and three others who have worked with them in prior roles, with two unelected female cronies to be added later. This is nothing if not entrenchment.

Finally, the Company’s attempt to paint our campaign as an attempt to gain “control” of the Board is nothing more than an artificially manufactured narrative designed to obscure the fact that the Board has become stacked with underwhelming, interconnected directors and to deprive stockholders of a fair say. In fact, all the directors we have nominated to the Board are fully independent of Sonic and of each other. Sonic did not personally know any of its nominees until two months ago. Relying on its extensive network in the gene therapy field, Sonic simply identified highly respected leaders and experts in this sector and convinced them to serve on the Adverum Board, thereby bringing to the Company the kind of talent it had hitherto failed to attract. With Sonic’s nominees, the path to value creation is clear. With the incumbent regime, stockholders face confusion and obfuscation – and would be subject to whatever further machinations the incumbent Board has in store.

Adverum Has Lost the Confidence of Stockholders Through Persistent Mismanagement and Repeated Blunders

Scientific Mismanagement

In our view, a primary reason for Adverum’s depressed market value is the Company’s refusal to adequately address the ocular inflammation caused by ADVM-022, its gene therapy treatment for wet AMD. All gene therapies elicit an immune response, and pre-clinical studies for intravitreal gene therapy done by Adverum and others accurately foretold the resulting inflammation that would occur when tested in humans.

Consider the following series of unfortunate events:

- On September 12, 2019, Adverum reported the promising results of its ADVM-022 trial for the first time. At this point, the Company should have been prepared to discuss how it intended to mitigate the inflammation that was seen. Instead, the Company botched the presentation. The CEO at the time, Leone Patterson, who used to be the CFO before she was CEO, was insufficiently persuasive and the stock dropped by more than half. She is now the CFO again.

- Rather than fully characterizing the inflammatory response and testing alternative prophylactic regimens – as we privately advised it to do – the Company doubled down on topical steroid drops as offering the best solution.

- Fast-forward nearly a year: Laurent Fischer, who sits on three other boards – one as Chair – was named CEO of Adverum on June 15, 2020. The Board has allowed Dr. Fischer, reputed to be a capable turnaround artist, to instead chart a course of passivity, financial and scientific mismanagement, and stockholder disappointment.

-

On June 26, 2020, the FDA refused to approve Allergan’s Abicipar pegol, noting that “the rate of intraocular inflammation observed following administration of Abicipar pegol 2mg/0.05 mL results in an unfavorable benefit risk ratio in the treatment of neovascular (wet) age-related macular degeneration (AMD).” Skeptics immediately and predictably drew parallels to ADVM-022, and Adverum stock began a long descent from which it has yet to recover.

- As a former Allergan executive, Dr. Fischer should have been well-aware of the inflammation concerns surrounding Abicipar pegol.

- As the new CEO, Dr. Fischer had the opportunity to quickly reframe and refocus Adverum to thoroughly scrutinize the safety profile of ADVM-022 and to explore additional ways to mitigate the inflammation.

- Unfortunately, Dr. Fischer repeated his predecessor’s mistake and chose not to do anything materially different.

Botched Investor Communications and Capital Allocation

The Company’s current leadership has not fared any better in the world of investor relations than it has in the scientific development process. Consider the following:

- Contrary to the time-tested industry practice of presenting significant new data at scientific conferences, Adverum did a data dump on its second quarter earnings call on August 10, 2020.

- While the Company characterized this aberrational approach as “positive interim data,” suspicious market participants sent the stock reeling, falling 17% the following day.

- Unbowed by the reaction described above, Adverum recklessly announced a $200 million secondary offering, driving the stock further downward.

- The inept financing was finally completed at $13 a share, roughly half of where the stock stood when Dr. Fischer joined the Company.

To sum up, in just two months Dr. Fischer oversaw the value destruction that it took Ms. Patterson a full year to achieve: presiding over a halving of Adverum’s stock price. Consistent with our ongoing pattern of trying to work cooperatively behind the scenes, Sonic sent another private letter to Adverum’s CEO and the Board, reiterating the same advice that we had informally delivered numerous times: improve communications and investigate methods to control the inflammation better.

Ultimately, we believe that the blame for these glaring missteps lies in large part with a Board that has failed to provide the necessary oversight to create and sustain the market’s confidence in the drug development process.

The Board has also failed stockholders when it comes to other governance matters. To cite just a few examples:

- Non-employee director compensation has increased from $1.3M during 2018 to a staggering $6.2M in 2020! You may consider that a big increase in a very short time, especially when measured against performance and the steps many corporations have taken to moderate conspicuous compensation in the midst of a worldwide pandemic. Stockholders can draw their own conclusions.

- The Board has approved a compensation package for Dr. Fischer worth over $21M for the half year he served in 2020. As noted by the San Francisco Business Times, this is more than that earned by the CEO of Gilead, who runs a company with $25B in revenue.1 Do you think we got our money’s worth?

- The Board apparently believes it is perfectly appropriate for the CEO to go on a two-month summer vacation merely three months after joining the Company and one month after obliterating the stock price, all while failing to achieve any repeatedly articulated corporate objective. It is unfortunate for stockholders that Dr. Fischer apparently placed greater importance on supervising the harvest at his newly acquired winery in Italy rather than carrying out his fiduciary duty to stockholders.

Adverum’s Board Nominees Lack the Requisite Independence and Experience to Hold Management Accountable

We have absolutely zero confidence in Adverum’s proposed director slate, which lacks necessary experience and is riddled with conflictual relationships, and which includes one nominee who was looking to depart the Board before a miraculous overnight change of heart once Sonic sent a private letter to the Board. Stockholders are left to decide if they think the three best qualified directors to represent their interests at this critical time are loyalists to the CEO and the Chair, plus a flip-flopper who wanted out until he suddenly and unexplainedly wanted back in. At this key inflection point in Adverum’s life cycle as a public Company, we believe the addition of directors with ties to the Chair and CEO – directors who lack the highly relevant experience our nominees provide – would not serve stockholders well. Consider the following:

- Dawn Svoronos has no drug development, ophthalmology or gene therapy experience. She does not hold a degree in the biological sciences. Ms. Svoronos has longstanding business ties to Board Chair Patrick Machado, having served as director and chief commercial officer of Medivation, a company that Mr. Machado co-founded. She also served with him on the board of Xenon Pharmaceuticals. Stockholders are entitled to question her true independence from Mr. Machado, regardless of whether she technically meets a Nasdaq standard.

- Reed Tuckson has no drug development, ophthalmology or gene therapy experience. He has a director interlock with CEO Laurent Fischer, also serving as a director of CTI Biopharma, where Dr. Fischer is the Board Chair. Stockholders are entitled to question his true independence from Dr. Fischer, regardless of whether he technically meets a Nasdaq standard. Is a chum of the CEO likely to hold that CEO accountable for his failures?

- Tom Woiwode is a representative of Versant Ventures Capital IV, a 2008 vintage venture capital fund. On December 14, 2020, Versant Ventures Capital IV reduced its ownership in Adverum by distributing two million shares to its partners. On March 16, 2021, Sonic was explicitly notified by a Company representative that Dr. Woiwode would not be running for re-election as a director. The following day, Adverum announced in a press release a Board slate consisting of Ms. Svoronos, Dr. Tuckson, and Dr. Woiwode. Sonic does not believe that the Company’s disclosure on this subject has been helpful to stockholders trying to understand the overnight change of heart. Stockholders should be free to draw their own conclusions about the commitment of a sitting director who intended not to stand for re-election, only to overturn the official position conveyed to Sonic less than 24 hours earlier.

Adverum’s Board has had enough trouble competently performing its fiduciary duties. It is problematic to add people whose main qualifications are they have director interlocks with the Chair or CEO, yet disturbingly lack appropriate expertise in relevant fields. Unsurprisingly, governance experts take a dim view on compromised appointments like these. That the Board recklessly forged ahead with these inapposite, disappointing candidates reveals its insular outlook and misplaced priorities.

New Directors Are Desperately Needed

We believe that our director nominees would bring critical independent perspectives and deeply relevant experience that is currently missing from the Board and would position Adverum to thrive and deliver vastly improved stockholder value. In our view, these nominees are objectively better than those of the Company. Our nominees include the following:

-

Jean Bennett, MD, PhD – Dr. Bennett is Professor of Ophthalmology and Cell and Developmental Biology and a Senior Investigator in the F. M. Kirby Center for Molecular Ophthalmology at the University of Pennsylvania School of Medicine. She also has an appointment as a Senior Investigator at the Center for Cellular and Molecular Therapeutics, The Children’s Hospital of Philadelphia (CHOP). Dr. Bennett’s research on gene therapy delivery of RPE65 led to the approval of Luxturna, the first gene therapy for a genetic disease approved by the FDA and the first approved gene therapy worldwide. Dr. Bennett is director of the Center for Advanced Retinal and Ocular Therapeutics at UPenn, co-founder of GenSight Biologics, Spark Therapeutics, and Limelight Bio, and member of the Scientific Advisory Boards at Akouos and Sparing Vision.

We believe that Dr. Bennett’s extensive experience in the gene therapy field, and her experience with the business and regulatory hurdles to drug development, make her a valuable addition to the Board.

-

Jodi Cook, PhD – Dr. Cook has extensive experience in gene therapy development from initial research development through commercialization. She served as Head of Gene Therapy Strategy at PTC Therapeutics, Inc from 2018 until 2020. Prior to joining PTC Therapeutics, she was one of the founding members and Chief Operating Officer of Agilis Biotherapeutics, a clinical stage AAV gene therapy company, from 2013 until its acquisition by PTC in 2018. While at Agilis, she led the sale of the company to PTC Therapeutics in a deal that has represented significant value to all parties. She has more than 20 years of senior executive experience in the life-sciences industry and held leadership positions in several successful biotech start-up companies. Prior to her work in industry, Dr. Cook was an Assistant Professor at Arizona State University and Mayo Clinic, Rochester, MN. Dr. Cook currently serves as a director of Fennec Pharmaceuticals.

We believe that Dr. Cook’s extensive experience in the field of gene therapy, and her valuable industry knowledge and executive experience, make her a positive addition to the Board.

- Herbert Hughes – Mr. Hughes has over 30 years of experience in the financial industry as an advisor and leader of a diverse range of businesses.

Contacts

Investors:

Saratoga Proxy Consulting LLC

John Ferguson / Ann Marie Mellone 212-257-1311

jferguson@saratogaproxy.com / amellone@saratogaproxy.com

Media:

Sloane & Company

Joe Germani / Sarah Braunstein

jgermani@sloanepr.com / sbraunstein@sloanepr.com